Club Necaxa, NFTs & The Funding of Communal Institutions (Cafe Society Dinner Discussion #16)

My case for a bar & restaurant funding platform that combines emotional & monetary incentives

Cafe Society is Maxwell Social’s semi-weekly magazine on the intersection of community and society — an anthropological look at the underpinnings of what makes the world tick, written by David Litwak (@dlitwak) and the Maxwell team. Maxwell is building a new type of social club.

A couple months ago I was sitting down with a Maxwell investor when he started talking about NFTs and how I should think about how they applied to bars, restaurants and, potentially, Maxwell. I was skeptical — the digital art cat thing? WTF did that have to do with me?

For those that aren’t familiar, NFTs are “non-fungible tokens” — essentially they are digitally unique pieces of “art” that you can buy and sell. The “piece” above, Nyan Cat, went for $600,000 at auction. Yes, someone paid 600k for a GIF, you read that right. NFTs allow ownership of digital assets — it makes it possible to buy and sell GIFs, JPEGS, digital anything in the same way you would a Monet painting — for 600k you are the owner of this GIF above. The image above that I’m displaying is the digital equivalent of a photo of the Mona Lisa or a really really good fake — it’s not real but a representation of the real thing.

If this seems a bit absurd to you (what’s the point of “owning” the above GIF if I can just post it here for you to see . . . ) you aren’t alone, but blockchain enthusiasts point out that, in the end, how is this really THAT different from how the art world already works, where hundreds of millions of dollars are exchanged for an oil painting that might actually sit in storage to preserve the value and where the original is worth everything while its fraudulent exact replica is worth nothing — our assignment of value to art is already pretty absurd and has very little to do with access to or ability to enjoy the art itself. And in the end, isn’t currency itself a social construct? Our society assigns it value so it has value.

The big picture theory about why this is exciting to people though is that NFTs and a marketplace around them could democratize the art market for art creators (note - not just art investors), helping to support budding creatives and bring more beauty into the world as regular people like you and me could log into one of the many platforms sprouting up like OpenSea and buy an NFT, a piece of art that depicts some upside down dude in sunglasses, on the hope that it will double in value. NFTs can also be linked to real life art as well, not just digital.

Bars & Restaurants Are A Form Of Art

How is this relevant? Well, my friend pointed out that an individual Maxwell, a restaurant or a bar is more similar to a piece of art than to business.

At its core the best nightlife institutions and gathering spots create an emotional experience — you go to Balthazar because it reminds you of the pinnacle of Parisian dining — the smells, the sights, the tastes all evoke an emotional response. Just like art.

Just like art, the vast majority of these spots are WILDLY unprofitable.

And just like art, the vast majority of investors in restaurants, bars and more are doing it for a different reason — fun. People fund bars and restaurants because they are fun and they want to feel a sense of ownership, know the bartender, and be part of a community, and they have positive communal externalities for the rest of us.

Similarly, most people buying art are buying a pretty painting or poster off of Artsy or Etsy or a street vendor because they like the way it looks and makes them feel when they wake up in the morning and see it on their wall, not because they think it’s going to go for $1M one day at Sotheby’s.

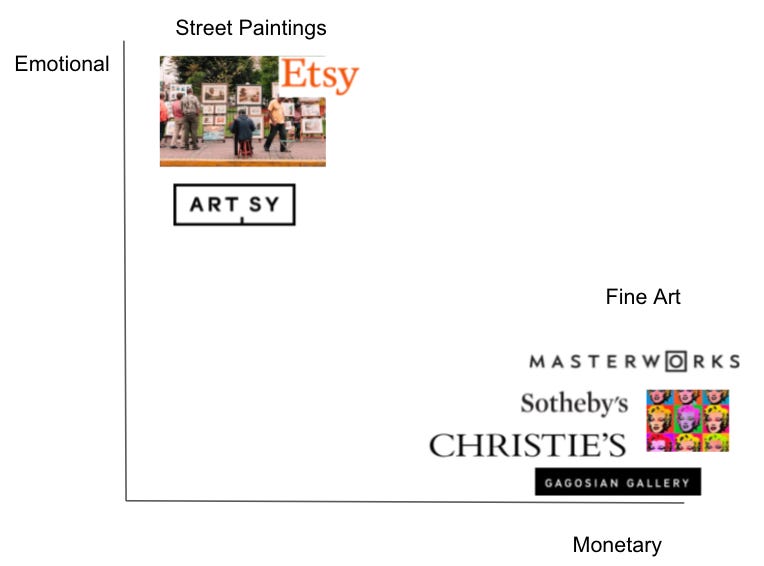

Emotional vs. Monetary Art Purchases

But of course there are some people who DO make money off of art — the aforementioned art collector who buys a painting at Sotheby’s and puts it in storage and sells it at a premium a few years later.

Artprice has an index that maps the Blue Chip art market (i.e. super expensive art) and it has actually outperformed the S&P over the last 20 years.

Masterworks, a digital platform to buy and sell fractional ownership in Blue Chip art, recognized this and their raison d’etre is to create an opportunity to buy a portion of a painting that is part of that index, or close enough to it, and get exposure to that market without needing to have a 100M USD net worth.

This leaves the art market divided into two categories on opposite sides of an emotional vs. monetary graph I just made up — emotional purchases (Etsy, Artsy, Street vendors) and monetary purchases (Sothebys, Masterworks, top galleries).

The interesting thing is companies like Masterworks that claim to democratize art investing by allowing people like me and you to purchase fractional ownership in a Keith Haring or a Warhol are not really doing anything to affect the art creation side of the market place. Masterworks is merely democratizing investment access to existing fine art, not democratizing access to investment for budding fine artists.

Saying Masterworks helps budding artists would be like saying Robinhood creates more companies, when in reality it just makes it easier for a normal person to invest in Snapchat.

You get on Masterworks by, well, becoming Basquiat, Monet or Keith Haring.

There isn’t much of a middle ground — the marketplace, and associated liquidity that allows for speculation and monetary incentives to purchase art, exists only for the top 1% of the market.

New Artists Rely on Emotional Purchases Only

This leaves the new artist market almost solely supported by emotional purchases.

Below the 1% of top artists, people are buying your painting because they want to wake up to it everyday in their home.

These paintings are bought on Etsy or on Artsy or in lower tier galleries where the people buying the painting or drawing might have no expectation of being able to ever sell that art again.

Because in all likelihood they can’t — there is no liquidity in the art market below the top 1% and chances are the $50 painting you bought will NOT be the next Keith Haring that sells for a million dollars, and you probably wouldn’t want to hold it for 20+ years even if it would be.

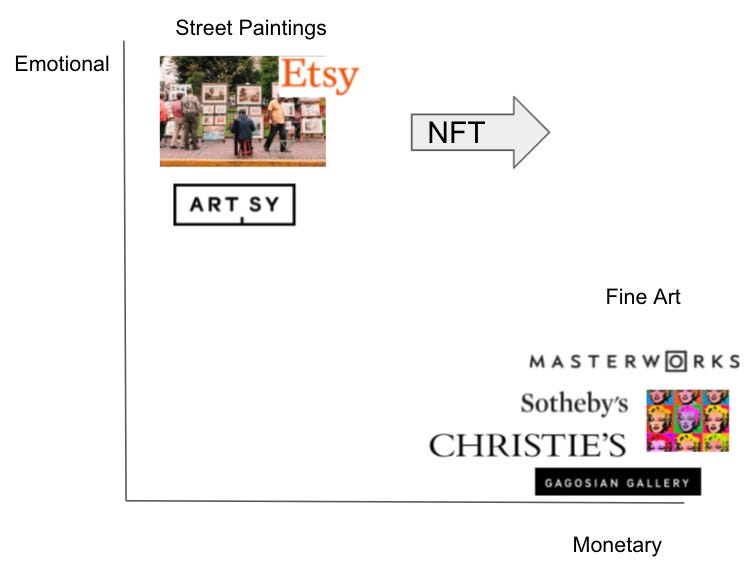

NFTs Add Liquidity To The Art Market Below the Top 1%

The interesting thing about NFTs is that for some reason I don’t quite fully understand, it seems to be providing an on-ramp for new art creators — a bunch of people are purchasing work from new artists and displaying speculative behavior you’d normally only see at Christie’s, Sotheby’s or Masterworks, but at the new artist and small transaction value level.

Artists that would previously have had to 100% rely on emotional purchases, now have additional tools at their disposal — there are tons of people looking to buy NFTs as small as $100, in large part because they are hoping they are worth $1,000 if that artist goes viral.

A real market needs liquidity, an ability to get out of the investment if you need to, to thrive. And considering that speculation on value is the only way real money is made in art (A Monet doesn’t pay dividends), being able to create monetary incentives to buy new art below the tier of “Leonardo de Vinci paintings” is super healthy for the market.

NFTs have somehow moved the incentive structure around creating & investing in budding artists to a place where emotion & money interact more fluidly, unlocking additional liquidity.

Art is to NFT as Restaurant/Bar/Maxwell is to _____?

As we learned raising money for Maxwell, the process for raising funds for a bar/restaurant is similarly miserable to what an early artist goes through because it’s ALSO almost solely an “emotional” purchase.

Public Service Announcement: Maxwell is NOT a bar or a restaurant but we were appealing to similar types of investors.

We heard stories of famous restauranteurs who took years to raise the funds for their first restaurant.

When we found an investor who had invested in restaurants before it was often actually a negative signal — that person was likely to have lost their money and was not keen to do it again. They had made an emotional decision, lost their money, and learned their lesson.

We realized the dirty little secret of almost all restaurants is they are funded by hedge fund guys, often for ego reasons.

But we struggled to figure out how the hell you find these rich people who are interested in investing not for monetary reasons but for social reasons.

If NFTs are changing that dynamic for art, what’s the solution for bars, restaurants and dare I say, future Maxwells?

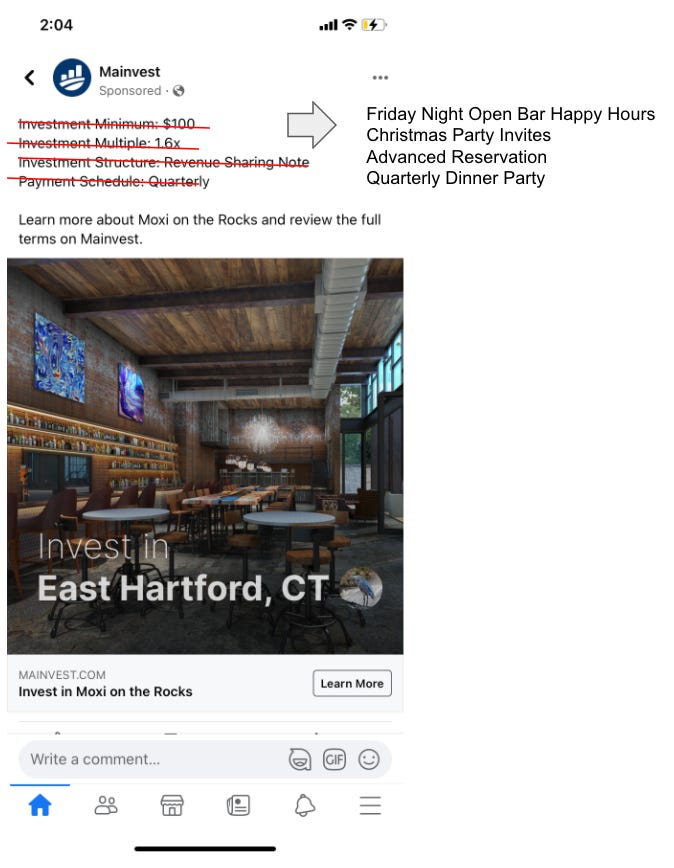

A Platform For Funding Leisure Businesses with Positive Communal Externalities

The current platforms to fundraise for small business, like NextSeed by Republic, Mainvest and more pretend like you ALREADY invest in bars and restaurants for rational financial reasons, pitching me on a 1.45x return as if I was weighing The Rabbit Hole HTX as a valued part of my diversified portfolio.

But anyone who is not brain dead has heard how often restaurants fail and knows they are, on average, mediocre businesses.

This would be fine if they were changing the marketplace dynamic like NFTs are for Art and adding liquidity (“I think this bar is going to be hot and I can cash out in a few months right after they launch”). But they aren’t.

That lack of liquidity forces you to make a much more high stakes decision — “I think this will be a good thing to tie my money up in indefinitely” which puts a serious damper on any financial incentives — imagine how little investing would get done if in order to buy Snapchat stock you had to decide you were ok leaving your money in the company indefinitely?

As a consequence, with no real marketplace, the funding decision is usually made for emotional reasons.

On the other side of the spectrum you have restaurant ownership groups, nightclub conglomerates, etc., who have access to capital because they have already proven themselves — these are the Keith Harings and Jackson Pollocks of the bar/restaurant world — bankable names like TAO and Major Food Group and Eataly that have a following — sure cultural bets.

To me the current funding platforms are the worst of both worlds, making a financial pitch for a sector of the market that is currently primarily driven by emotional motivations.

The savvy monetary nightlife investors aren’t investing in spots on Nextseed or Mainvest. And the people investing in local spots who ARE savvy are doing it for emotional reasons and are aware that they’d be happy to just get their money back and have a good time.

So it begs the question — what is the right answer?

My first inclination was — just build a platform that recognizes and leans into the real reason we fund these types of communal “businesses” — for fun, a Kickstarter for the Leisure Industry.

Why isn’t there a platform that allows Mario Carbone to fundraise for his next restaurant, and if you’re an investor, yeah you hope to get your money back and maybe a little extra, but you mainly paid the 10k minimum investment because it includes a yearly invite to the holiday party, 4 dinner parties a year and priority table reservations?

When you move to Brooklyn and have kids, you can sell that ownership stake at a profit if the community is thriving, and the associated social benefits of it, to someone else who wants to become a member in the community and go to the dinner parties.

But I think that would still relegate this type of financing to the fringe — I think the key is to understand that to move to that top right part of the graph, you need monetary AND emotional payoff to be combined.

You need additional liquidity.

Is The Entry Point Sports?

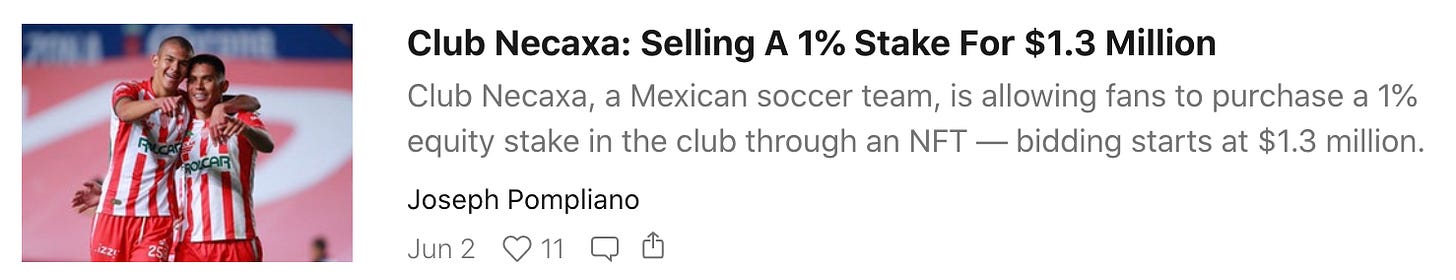

When I heard that Club Necaxa, a major Mexican soccer team, was selling 1% of the club through an NFT last week in an article in the great newsletter, Huddle Up, I thought it could hint at the answer to this question.

Sports, in many ways, is the ULTIMATE emotional experience and the ultimate communal institution.

The Green Bay Packers once sold shares to fans, and to prove that it was an emotional purchase look no further than this article detailing “Why Green Bay Packers Shares Are Totally Worthless.”

The Packers label their slivers of ownership “common stock.” It pays out no dividends. No equity interest. No ability to trade it. It’s largely a gesture from fans towards the team, a vote of confidence.

That isn’t to say that there are no perks at all. Shareholders get invites to a yearly meeting with the front office and access to shareholder-only merchandise.

The Green Bay Packers understood that their stocks were being bought for emotional reasons, not for rational financial returns.

But what if you COULD sell those shares? Necaxa is doing Green Bay Packers Shares 2.0, but adding the financial speculation incentive by launching it as an NFT which theoretically, will make it more likely that there is an actual market for it, i.e. liquidity, giving additional monetary incentives.

Joseph Pompliano asks, and answers, a good question:

Traditionally, the value of NFTs has been the ability to authenticate an item through a digital signature. So the real question becomes: if this 1% equity ownership stake can be certifiably authentic without being an NFT, what is the value in launching it as an NFT?

Amen — I’ve often been frustrated with digital currency enthusiasts who don’t realize themselves how to communicate to me how what they are doing is different from Frequent Flier Miles. So why is this special?

The real value of NFTs lies at the intersection of a highly engaged audience, great creative, special access, and desirable utility. If NFT issuers can put those four criteria together, they have the chance to create an incredibly valuable product.

So in short, the tech matters only as much as it facilitates a highly engaged audience + utility.

Perhaps sports is the perfect launch market for this, being able to move highly engaged audiences all at once.

Crypto Will Create MORE Middleman, Not Less

A common use case you hear a lot about RE Bitcoin is dis-intermediating banks and national currencies. The Crypto-propaganda, at least to a lay person like me, is that the blockchain is technology that will give us freedom from imperious middlemen who control our destiny.

But watching NFTs and a corresponding market for the art world explode made me realize the real value of crypto may not be displacing middlemen in markets that have plenty of them but creating MORE middlemen in markets where the few middlemen that do exist do so to serve the super privileged.

We need more ways to fund art than simply the art gallerists that often only take on artists that are already prominent and bankable, and more ways to fund communal institutions than restaurant groups that only fund Michelin starred chefs and the latest TAO nightclub.

During our fundraising process I would have killed for something in hospitality resembling any of the hundreds of VC firms and angel investors who make up the other side of the tech/VC funding marketplace.

I would have killed for middlemen, for a thriving marketplace, instead of having to operate through random introductions.

There are 11,000 liquor licenses in NYC alone, almost all of whom probably went through the miserable process we went through, or said fuck it and put their own money into the project.

It’s these social & communal experiences, the bars, restaurants, the art, the sports teams that make up a huge part of what makes life worth living, yet we have a real agency problem — we largely rely on the rich to fund them for emotional reasons.

I have some hopes that some of the same dynamics that have started emerging with art and NFTS can be applied to the “leisure” industry and I’d love to speak to anyone who has thought about this from either perspective, blockchain/crypto or bar, restaurant and sports teams. Reach out!

If you enjoyed our newsletter forward to a friend, subscribe and follow us on Instagram.

David (@dlitwak) & The Maxwell Team

The only idea I have around this is to issue a token that will represent a club membership. Like, if the club will go viral, then your membership may be sold at a higher price than you originally bought it.

As an extension, the particular membership may have some additional statuses attached, which gives some privileges in the club, which may also increase the price. If you visited all events of the club the past few years, you may earn an "always there" status, which gives 5 free shots at any event. But, these statuses are not a part of the token and need to be stored in a separate service.